A 365 Day Difference in Homeownership

A 365 Day Difference in Homeownership

Over the past year, mortgage rates have fallen more than a full

percentage point. This is a great driver for homeownership, as today’s

low rates provide consumers with some significant benefits. Here’s a

look at three of them:

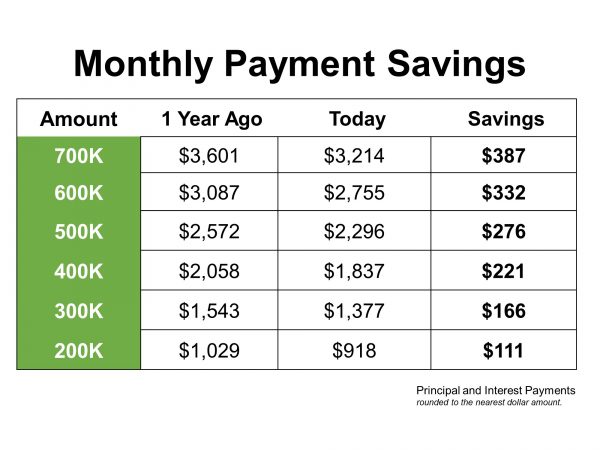

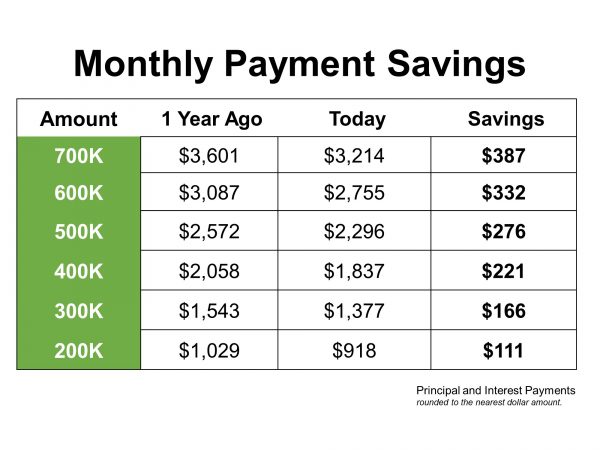

The chart below shows how much you would save based on today’s rates, compared to what you would have paid if you purchased a house exactly one year ago, depending on how much you finance.

- Refinance: If you already own a home, you may want to decide if you’re going to refinance. It’s one way to lock in a lower monthly payment and save substantially over time, but it also means paying upfront closing costs too. You have to answer the question: Should I refinance my home?

- Move-up or Downsize: Another option is to consider moving into a new home, putting the equity you’ve likely gained in your current house toward a down payment on a new one that better meets your needs – something that’s truly a perfect fit for your family.

- Become a First-Time Homebuyer: There are many financial and non-financial benefits to owning a home, and the most important thing is to first decide when the time is right for you. You have to determine that on your own, but know that now is a great time to buy if you’re considering it. Just take a look at the cost of renting vs. buying

Why 2019 Was a Great Year for Homeownership

Last year at this time, mortgage rates were 4.63% (substantially higher than they are today). If you’re one who waited for a better time to make a move, market conditions have improved significantly. Today’s low mortgage rates combined with increasing wages are making homes much more affordable than they were just one year ago, so it’s a great time to get more for your money and consider a new home.The chart below shows how much you would save based on today’s rates, compared to what you would have paid if you purchased a house exactly one year ago, depending on how much you finance.

Comments

Post a Comment