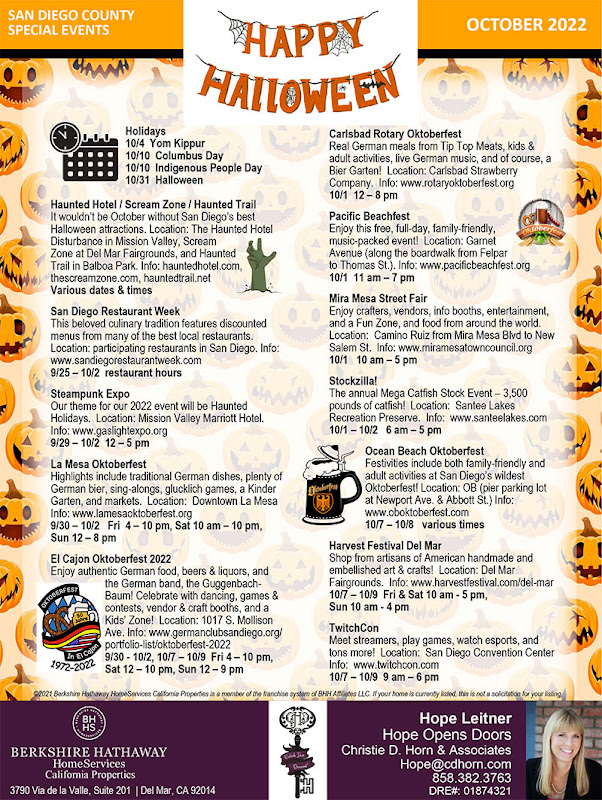

Calendar of Events in San Diego October 2022

While it's still very hot, we've had a couple of cooler nights recently. Pretty soon we'll be adding blankets back on the bed. With a new season here, San Diego will never run out of things to do. Scroll down for a good list of local pumpkin patches. Personally, the Carlsbad strawberry farm is my favorite. If you know anyone who might be interested in receiving this event calendar every month, please have them sign up at this link. PONDER THIS - “I went to the woods because I wished to live deliberately, to front only the essential facts of life, and see if I could not learn what it had to teach, and not, when I came to die, discover that I had not lived.” Henry David Thoreau - We are all moving through life in our good time. Some people jump on change to make it happen! Other people contemplate their options. Are you contemplating a change? Remember, I am always here for my clients and their friends and family. HOPE OPENS DOORS