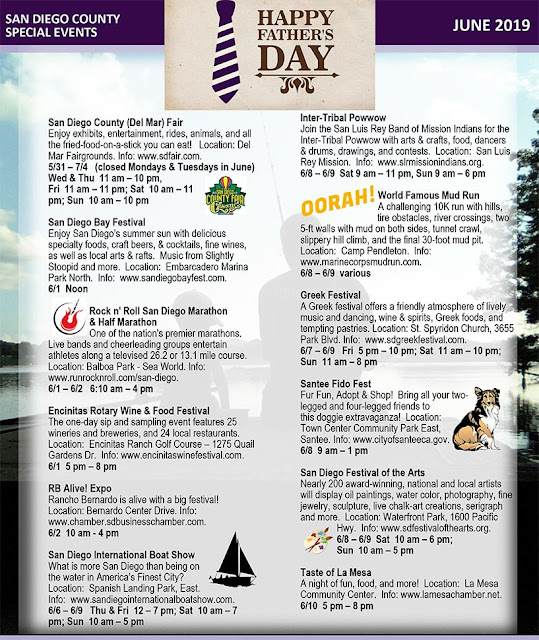

June Calendar For San Diego County

San Diego Real Estate Agent with Berkshire Hathaway HomeServices, California Properties. My mission is to empower my clients with expert guidance and exceptional service to help them achieve their real estate goals and dreams. With honesty, integrity, and innovation at the forefront, I commit myself to crafting lasting relationships and community connections. Together, we're not just conducting transactions; we're shaping futures and building legacies. Hope Opens Doors DRE #01874321