Opportunities don’t happen. You create them—especially in real estate.

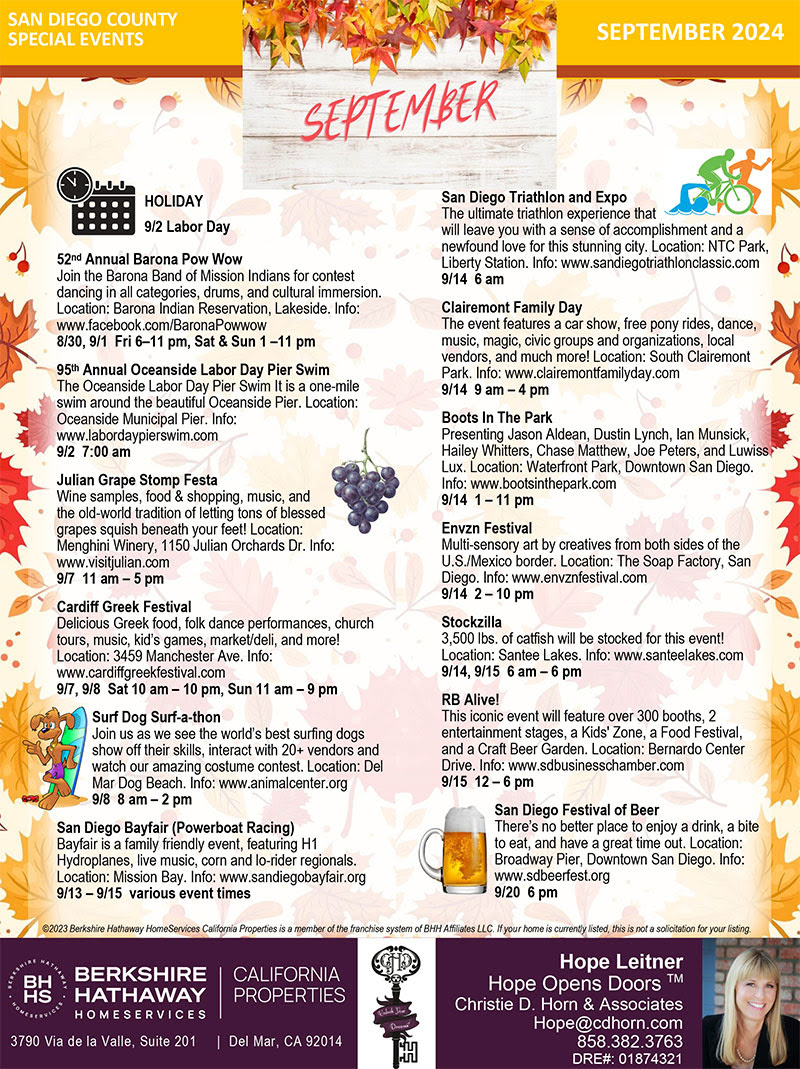

"Opportunities don’t happen. You create them—especially in real estate.” I truly believe that the right time and place can make all the difference. Whether you're thinking about buying or selling. I believe every step in the process, from exploring your options to finding the perfect home, is a chance to create something amazing. ✨ R eal estate isn’t just about buying and selling properties; it’s about creating new beginnings and making dreams a reality. Let’s talk and see what’s possible. 🏡✨ Follow and DM me today! Hope Leitner Berkshire Hathaway Home Services 📞 858-382-3763 📧 hope@cdhorn.com

.png)