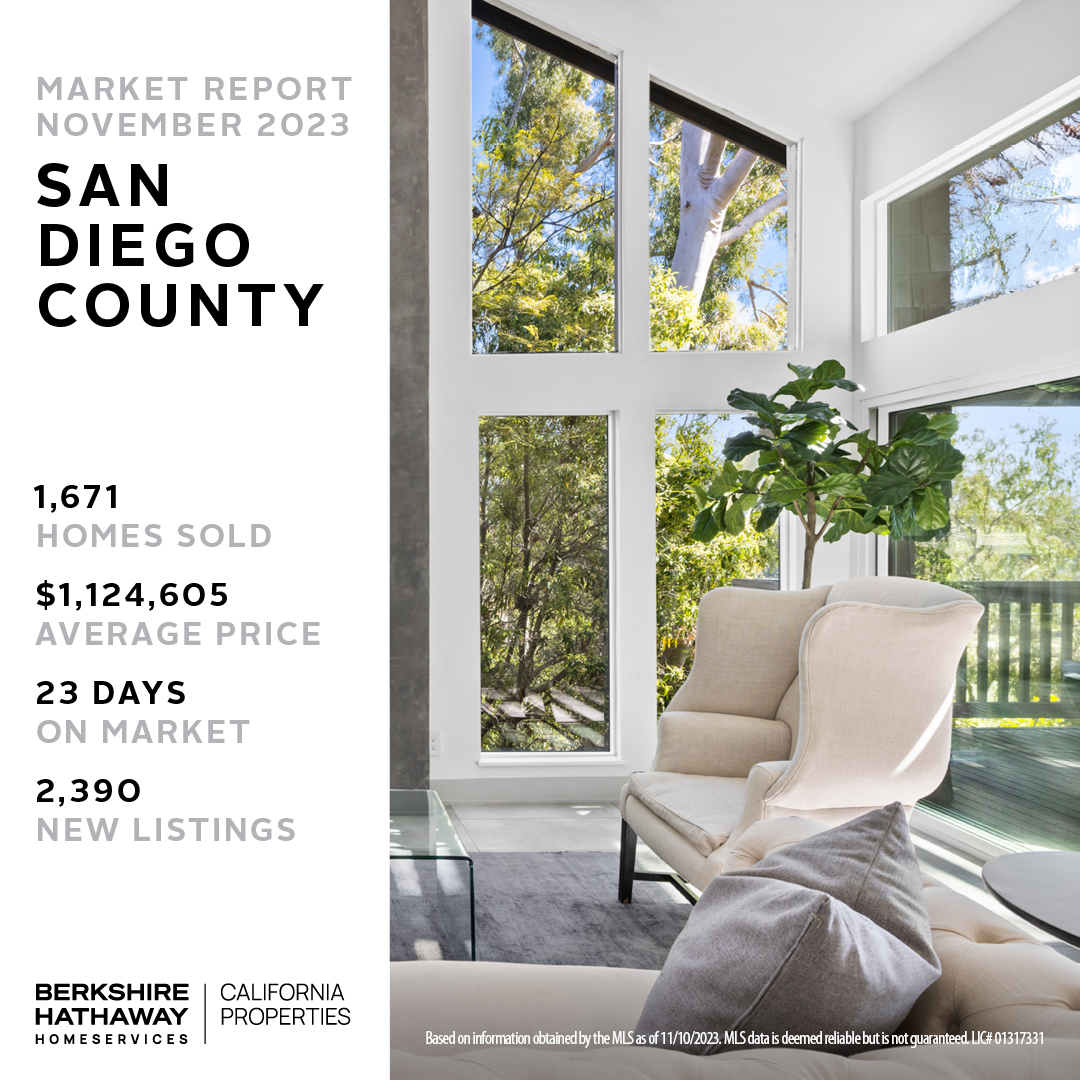

San Diego November Real Estate Market Update

Below are November's market report and the two previous month's reports for comparison. San Diego is desperate for home sellers. Inventory is low for the number of buyers. Just last week interest rates dropped more than 1% and buyers leapt at the opportunity. If you've been considering a change, downsizing, retiring, moving to your dream location.... Now is a great time to sell! Whether you're considering buying or selling, give me a call so we can talk about your realistic options in our unique housing market. If you know anyone who might be interested in receiving this market update every month, please have them sign up at this link. December - Ponder this, "California dreamin' on such a winter's day." — The Mamas & The Papas - While the world dreams of living in our sunshine we are here already. I’m so happy that this is home for me, and grateful for the sun that greets me almost every day here. I am always here for my cli...