Alternative Investments

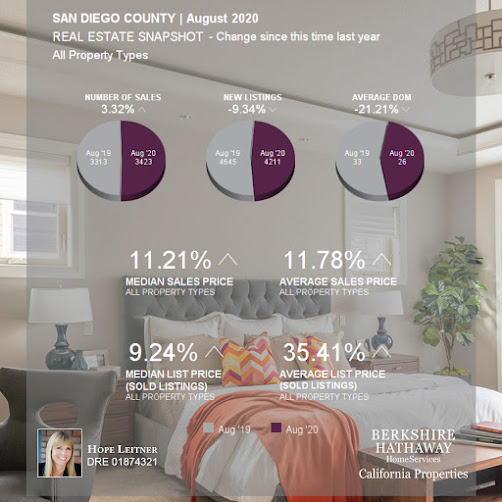

In a recent article, The Wall Street Journal reported that investors have rarely been this flush with cash. The economic uncertainty due to the pandemic and the volatility of the stock market has caused assets in money-market funds to increase to approximately $4.6 trillion, the highest level on record according to Refinitv Lipper. The question becomes should an investor be "out of the market" until things settle down or should they seek to find alternative investments to produce satisfactory results. Even in the middle of this uncertainty, residential rental property has been a stable performer. Rents are continuing to increase along with values. Investor mortgages are available at 80% loan-to-value at fixed interest rates for 30-year terms. Most other investments must be purchased for cash or at best, are limited to low loan-to-value loans, at floating interest rates for relatively short time frames. The use of borrowed funds, especi...